Gold Tokenization Explained: How to Create a Tokenized Gold Platform

Do you know how tokenization of real-world assets (RWA) is transforming the digital market? Are you trying to know about gold tokenization development?

As of 2025, the global gold market took a new turn with new heights that exceeded $10 billion in assets under management (AUM). These facts changed the whole perspective on gold. With blockchain technology, gold platforms are changing their ideology of global trading. These developed enhanced payment methods, transparency, user security, and liquidity.

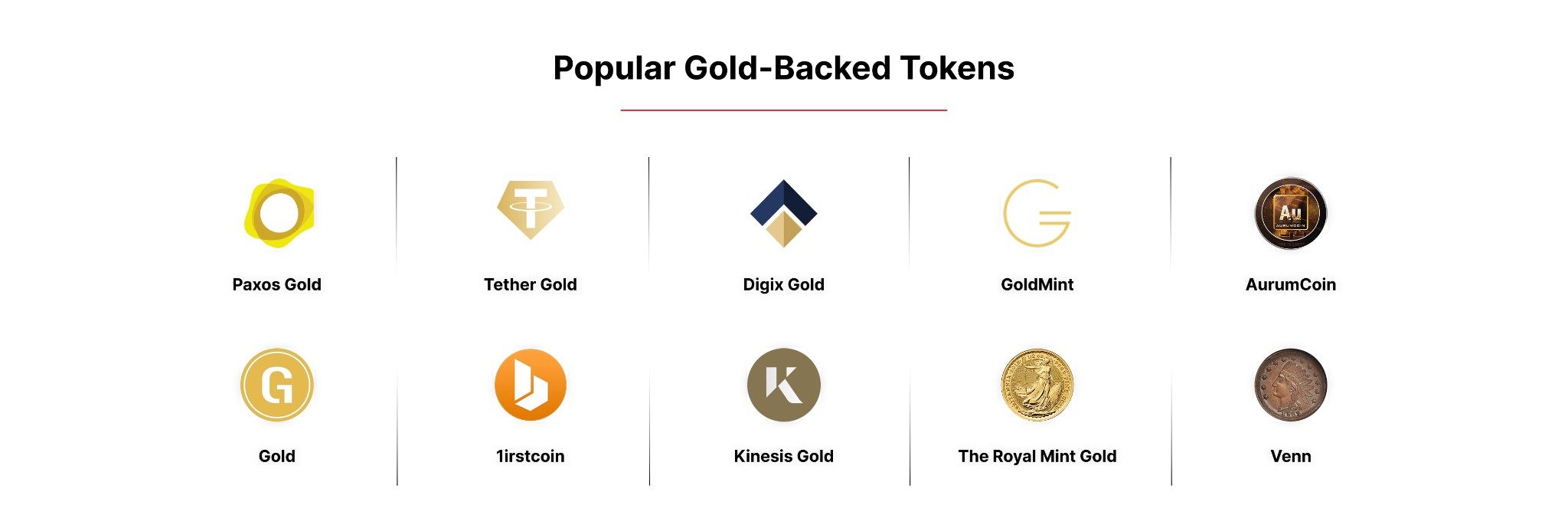

Several projects, ie, Tether Gold (XAUT), Paxos Gold (PAXG), and Perth Mint offerings pushing for secure blockchain-based gold tokens adoption. Although many other precious assets like silver, diamonds, and real estate are gaining momentum but gold has its place in the sky.

In this guide, you could explore the fundamentals of gold tokenization, its benefits, regulations, industrial cases, and may more. If you are also looking to build a secure and scalable gold-backed token, then Solulab is at your service. At SoluLab, we navigate the technical and compliance complexities of launching successful tokenized assets.

What is Gold Tokenization?

Gold tokenization is a process that represents physical gold assets in digital tokens on a blockchain network. Each token has a specific weight, or to say, a unit of gold. This is demonstrated in grams, ounces, or kilos and pegged as 1:1 by physical reserves.

These are held securely under audited vaults. These tokens also act as digital certificates of one’s ownership. Hence, allows individuals and institutions to trade as they wish. This tokenization process ensures security, logistics, and there will be no problem with physical transportation.

Core Concept:

Tokenizing gold turns a traditionally illiquid, high-barrier asset into a digitally liquid, fractionally tradeable, and globally accessible financial instrument.

How Gold Tokenization Works: Step-by-Step Breakdown

Developing a gold tokenization platform needs a clear and structured process. It blends blockchain technology, real gold storage, smart contracts, and legal checks.

1. Physical Gold Procurement and Custody

As we all know, gold is generally brought in physical form, like bars or bullion, and stored safely in third-party vaults. These vaults are managed by expert custodians who have a strong industrial reputation.

To build trust, the gold is regularly checked through audits. These vaults have insurance that protects gold from theft or any kind of malpractice. Hence, gold is secured.

2. Token Issuance on Blockchain

Once gold is secured, the developer team creates smart contracts through blockchain technology. Commonly known blockchain platforms are Ethereum, BNB Chain, Polygon, and Hyperledger Fabric.

Each token created showcases a fixed and verifiable gold storage amount or value. This link between token and gold makes the system transparent and trustworthy.

3. Token Distribution and Sale

After the tokens are minted, they are made available for buyers. People can purchase them on crypto exchanges or over-the-counter (OTC) platforms.

Some platforms also offer custom apps where users can buy tokens directly. Every token transaction is recorded on the blockchain, including ownership and audit trails.

4. Redeemability and Secondary Trading

Investors can redeem their gold tokens for physical gold. This is subject to platform policies and delivery limits based on location.

Alternatively, tokens can be traded on secondary digital markets. This offers flexibility and allows investors to exit easily when they choose.

Types of Gold-Backed Tokens in Asset Tokenization Ecosystems

Gold tokenization comes in many forms. Each type serves different investor needs across retail, DeFi, and institutional finance.

- Fungible Gold Tokens

These are blockchain tokens that represent small units of gold. Built using ERC-20 or BEP-20 standards, they are easy to trade.

They work well with most wallets and exchanges and are popular in DeFi platforms due to high liquidity.

- Gold-Backed NFTs

These tokens represent specific gold bars. Each NFT carries unique details like weight, purity, and serial number.

Collectors and high-net-worth investors use them as digital certificates of real gold ownership.

- Gold-Pegged Stablecoins

These tokens follow the market price of gold. They offer a stable value during inflation and economic uncertainty.

Investors use them for remittances and global transfers, avoiding currency risks.

- DeFi-Enabled Gold Tokens

These tokens work within DeFi platforms. Investors can lend, borrow, stake, or farm yield using their gold-backed tokens.

It helps generate returns without selling the gold asset.

Benefits of Gold Tokenization for Investors and Enterprises

Gold tokenization brings strong advantages to investors and businesses. It increases access, reduces costs, and builds trust.

- Increased Liquidity and Global Access

Tokenized gold trades 24/7 on global platforms. Investors don’t face limits like market hours or national borders.

- Fractional Ownership and Investment Inclusion

Investors can buy small parts of gold. This makes gold affordable for retail users and emerging market participants.

- Enhanced Security and Transparency via Blockchain

Blockchain technology, developed by top gold tokenization development companies, records every transaction. Also provides transparency and develops user trust.

- Efficiency, Compliance, and Cost Reduction

Smart contracts are used to avoid middlemen involvement. Also, reduce the expenses, speed up transactions, and enhance built-in legal compliance.

Real-Time Industry Adoption (2025 Market Snapshot)

- PAX Gold (PAXG): Over $750 million in market cap as of June 2025

- Tether Gold (XAUT): About $600 million in gold reserves

- PMGT: Linked to Australian government gold reserves

- Maple Finance & Aave Arc: Now accepting gold tokens as lending collateral in DeFi

Use Cases: Where Gold Tokenization is Making an Impact

- Gold Investment and Trading Platforms

Platforms offer gold tokens to attract digital investors. Many prefer them over ETFs or physical gold. - Asset-Backed Stablecoins

Gold-pegged coins offer a safer option than USD-based stablecoins. They protect against inflation. - Digital Wallet Integration

Gold tokens can sit alongside crypto, fiat, or silver in digital wallets. - Collateralized Lending in DeFi

Gold tokens help users borrow crypto without selling their gold. - Institutional Hedging and Settlement Solutions

Banks and governments explore tokenized gold for global settlements and reserve management.

Challenges and Risks in Gold Tokenization

Though promising, gold tokenization has challenges. These include legal issues, vault safety, and blockchain security.

Regulatory Uncertainty

Rules differ by country. Some treat tokenized gold as a security, others as a commodity or digital asset.

Custodial Risks

Physical gold must stay safe. Poor vault practices or false audits can ruin investor trust.

Smart Contract Vulnerabilities

Weak coding or missed bugs can risk funds. Smart contracts need regular audits and testing.

Market Volatility

Gold is stable, but crypto exchanges can cause price swings. Investors should remain aware of market risks.

Step-by-Step Gold Tokenization Development Process

Developing a gold tokenized platform requires reliable planning, scalable systems, and strong security at each step. Let’s check the following phases to understand the process in detail.

Phase 1: Business Requirement Analysis

The first is to identify the purpose and audience that includes retail, Defi, or institutional users. Knowing the customers’ requirements helps to make goals and required adjustments in the platform.

It includes checking laws in target countries. Development teams review AML, KYC, and securities rules early on. Experts then plan token supply, price, fee, and governance models for smooth operations.

Phase 2: Platform Design and Architecture

After planning, designers build user-friendly dashboards. Investors can view and manage gold tokens easily.

Developers choose the right blockchain. Public chains like Ethereum offer liquidity. Private ones like Hyperledger offer more privacy.

Back-end APIs are built next. These connect live gold prices, accounts, and third-party services.

Phase 3: Smart Contract Development and Testing

Here, developers write smart contracts. These control minting, burning, transfers, and user permissions.

Security testing follows. Teams run checks, audits, and simulations to ensure no bugs or hacks are possible.

Third-party security firms often verify the code for extra assurance.

Phase 4: Custodial and Vault Integration

Tokens must link to real gold in vaults. Developers build APIs to connect vaults with the platform. Gold reserve data is updated in real time. Tokens are only minted when gold is verified. This guarantees a 1:1 backing and builds investor trust.

Phase 5: Wallet, Exchange, and Payment Gateway Integrations

Tokens are easy to use, because they neither need storage nor physical safety. This makes developers add support for wallets, ie, MetaMask, Trust Wallet, and Fireblocks, for transaction purposes. Later, they also link centralized and decentralized exchanges for smooth trading and liquidity.

Payment gateways like Stripe allow users to buy gold using fiat money.

Phase 6: Platform Deployment

Once ready, the platform is launched. It may run on cloud servers (AWS, Azure) or private networks.

Engineers set up scaling tools and monitoring systems. These help handle traffic and detect any system issues.

Phase 7: Post-Launch Support and Upgrades

Support continues after launch. Teams update contracts, fix bugs, and add new features as needed.

They also monitor law changes. If gold token laws change, platforms must adjust to stay compliant.

Future updates may include NFTs for gold bars or more DeFi features to stay competitive.

Investment Opportunities of Gold Tokenization

Gold tokenization is a global change; this precious metal is turning the global economy. From physical gold bars to digital gold tokens, technology is ushering in a new era.

However, safety, flexibility, and trust are basic building blocks for every investor and industry. Let’s check some key investment opportunities that gold tokenization brings.

- Fractional Ownership

Gold tokenization is not only for a high range of investors, its main focus is to let customers buy small portions of gold. This leads to a high number of customer base and makes investments easy. Even a few grams or milligrams of gold can be owned digitally.

- Enhanced Liquidity

Selling physical gold often takes time and effort. It needs paperwork, buyers, and sometimes middlemen.

With tokenized gold, buying and selling happen instantly on digital platforms. This creates higher liquidity and makes gold a much more active asset in modern portfolios.

- Global Accessibility

Gold tokens can be bought and sold from anywhere in the world. No need to physically move the metal.

Online platforms allow investors from all regions to access gold markets easily. This removes borders and expands global participation in gold investment.

- Lower Storage and Security Costs

Physical gold needs secure vaults or lockers, which cost money. Tokenized gold removes this hassle.

Ownership exists safely on the blockchain, with no physical storage required. Blockchain technology adds extra protection against theft or loss.

- Integration with Decentralized Finance (DeFi)

Gold tokens now work in the DeFi world. They can be used for loans, staking, or liquidity farming.

This creates more financial opportunities than traditional gold ever allowed. Tokenized gold fits smoothly into automated DeFi strategies, adding utility and earning power.

- Real-Time Market Exposure

Gold tokens give investors direct exposure to market price changes. No need to wait for deliveries or paperwork.

This fast access helps investors respond quickly during market shifts, especially when gold acts as a safe asset in uncertain times.

Future Trends: What’s Next for Gold Tokenization?

The future of gold tokenization is linked to the broader growth of real-world asset (RWA) tokenization and Web3 finance. Here are the top trends that every entrepreneur must know.

- Integration with Central Bank Digital Currencies (CBDCs)

Governments may use tokenized gold to support new digital currencies, especially in developing countries.

Tokenized gold could act as a stable backing for CBDCs, adding trust and reducing volatility.

- DeFi Collateralization of RWAs

DeFi projects like MakerDAO and Aave Arc are testing gold-backed tokens in lending pools.

This trend will likely grow, bringing more real assets like gold into decentralized lending systems.

- Growth of Multi-Asset Tokenization Platforms

Enterprise platforms are planning to offer bundled asset tokens. These may include gold, silver, copper, and diamonds.

Such unified dashboards will allow investors to diversify easily across different tokenized commodities.

- Institutional Adoption

Banks like HSBC, Standard Chartered, and JPMorgan are exploring gold tokenization for settlement and trade. Their involvement signals rising trust and a shift toward tokenized gold in traditional finance.

- Regulatory Standardization

Global agencies, the BIS and FATF, are working on developing clear systems following the regulations on tokenized assets. As of 2026, it’s expected to see emerging global standards on gold tokenization and other commodities.

Conclusion: Embracing the Digital Transformation of Gold Investment Through Tokenization

The details mentioned in this guide reflect how gold tokenization is reshaping the digital assets market. Once a dream, now become a practical concept. Forward-thinking enterprises in the blockchain, digital assets domains must adopt this technology to gain customers. As global investors now looking for gold token adoption, the drive is rising to new heights.

This shift is not only changing traditional methods but also creating new avenues for digital investors. To stay ahead of this digital era, partner with SoluLab, a leading gold tokenization development company. We help you in the integration of tokenized gold assets into the blockchain ecosystem. Contact us today to unlock unprecedented growth in the precious metal market.